- Summary

- Supply, Demand, and Economics

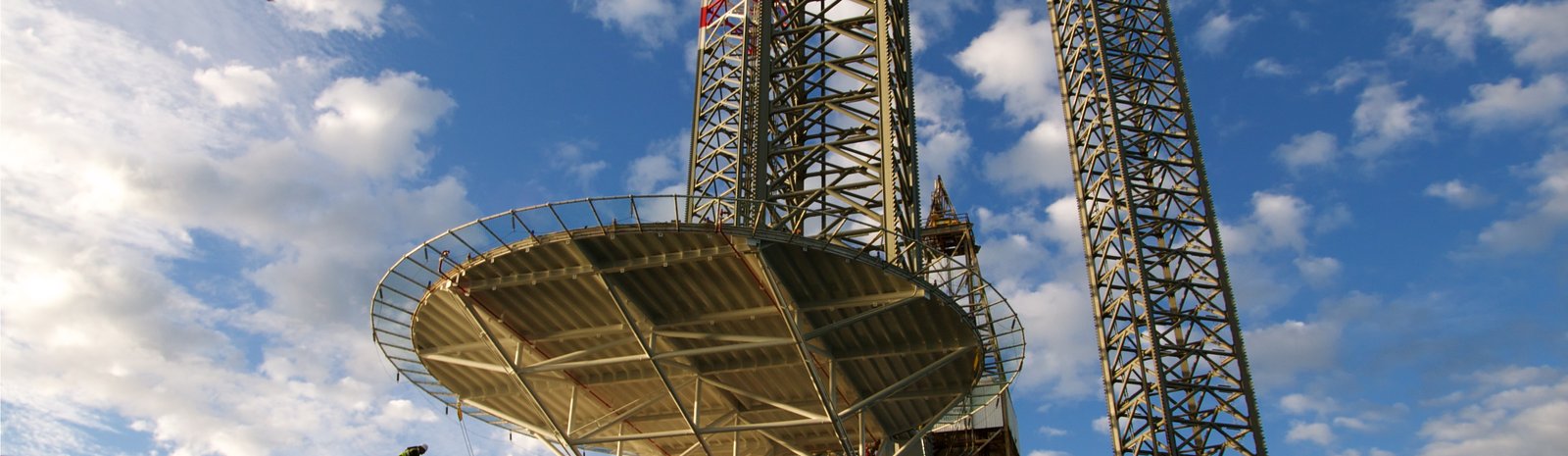

- Exporting Liquefied Natural Gas (LNG)

- Future of Natural Gas in Cook Inlet

- A Turnaround?

- Environmental Impact

- Conclusions

Summary

The natural gas produced in Cook Inlet is the primary source of energy and heat for the majority of Alaska’s population. However, reserves have been declining for many years and exploration has not keep pace with demand. Production from current reserves is expected to meet only half of projected demand by 2017, a shortfall of 50 billion cubic feet. Solutions to the shortfall include increased exploration and development in Cook Inlet, pumping gas from existing fields on the North Slope, development of other energy sources such as coal or renewables, or the importation of liquefied natural gas (LNG).

All of the proposed solutions to make up the gas shortfall have at least one of the following issues: a) require significant government investment, b) take many years to come online, c) lead to significantly higher energy prices, or d) all of the above. Natural gas will continue to be a hot political issue in Alaska for the foreseeable future, electricity customers will almost assuredly see higher prices, and Cook Inlet’s gas will probably be supplemented by a combination of alternative sources of gas supply and alternative sources of generation.

Related Essay:

Now vs. Never vs. Later - Natural Gass in Cook Inlet and the pitfalls of short-term planning

A combination of a favorable tax environment, high oil prices, and an expanded gas resource estimate for Cook Inlet sparked a new wave of exploration in 2011.

Supply, Demand, and Economics

The Railbelt of Alaska, which stretches from Fairbanks through Anchorage to the Kenai Peninsula, uses 80% of the electricity in the state. Around 70% of that electricity comes from natural gas, almost all of it produced in Cook Inlet. Since 1958 the region has produced 7.8 trillion cubic feet (tcf) of natural gas, as well as 1.3 billion barrels of oil.

The population of the Railbelt has increased by 170% since 1970, while known reserves of Cook Inlet gas have fallen by 80% over the same period. As a result, the supply of gas from current reserves will only be enough to meet half of the demand by 2017 (5 MB), a shortfall of 50 billion cubic feet (bcf).

However, this doesn’t take into account the recent (Fall 2011) discovery of a 3.5 trillion cubic foot field in Cook Inlet by Escopeta. How much of this gas will be economically recoverable is unknown, as is the time to develop production (estimated 2013), but the new field may prove to be a critical part of the energy supply puzzle.

Expanding supply will be more expensive than in the past because most of the easily accessible gas has already been extracted. A recent study commissioned by Cook Inlet utilities estimated that the cost to explore for gas from 2010-2020 would be up three times the dollars expended in 2001-2009. At current natural gas prices, exploring for new gas in Cook Inlet may not be profitable. Expensive exploration will take place only if gas prices rise high enough to justify it, or if exploration is subsidized by the state.

Another facet of reduced production is a reduced ability to mange large swings in demand. When gas was abundant, producers could simply pump more at times of peak demand. But a reduced rate of production means that fluctuations in demand need to be smoothed out by storage facilities of which there are currently none in Cook Inlet. Construction is currently underway for a $180 million storage facility on the Kenai Peninsula that should partially alleviate this problem. During low-demand periods, excess supply will be pumped into storage, and during peak demand, gas will come both from fresh production and by drawing down storage.

Exporting Liquefied Natural Gas (LNG)

Most of the gas produced in Cook Inlet has been consumed by industrial activities, including fertilizer generation and injection into oil fields to enhance oil recovery. Since 1971 around a third of Cook Inlet gas produced each year has been exported, primarily to Japan in the form of liquefied natural gas (LNG). Exports have fallen off dramatically since 2008, and the Cook Inlet LNG plant was scheduled for closure in late 2011. However, new contracts have resulted in the plant being kept open for anticipated resumption of exports in the second half of 2012 (at least until the export license expires in 2013). Anticipated demand from Japan, in wake of the probable closure of several nuclear plants, may provide a source for continued exports.

Future of Natural Gas in Cook Inlet

The Railbelt consumes 70 billion cubic feet (bcf) of natural gas every year (32 for heating, 38 for electricity) and demand from Alaska’s major population belt is likely to rise over time. The addition of large industrial projects like the proposed Pebble Mine (requiring up to 300MW, around 25 bcf of gas annually), Donlin Gold (up to 130 MW, around 11 bcf of gas annually), or other major mining proposals would increase demand even faster. Given falling reserves, there are four general solutions to meet demand, each with its own set of concerns.

1) Dramatic increase in exploration of natural gas resources in Cook Inlet to keep pace with demand.

-Timeframe: At least several years given lag between exploration and production. Has already begun, driven largely by tax incentives from state.

-Up front cost: Relatively low, privately financed

-Long-term costs: Prices will have to rise, given the fact that the gas will be increasingly difficult to extract

-Other: Only achievable with state subsidies2) Pipeline from the North Slope to transport natural gas from the north of the state to the Railbelt (e.g. the “bullet line”, or “Valdez option” or “North America option”).

-Timeframe: Long, potentially decades

-Up front cost: Very high ($6-41 billion depending on details)

-Long-term costs: Once completed, ongoing costs would likely be relatively low until depletion of North Slope gas.

-Other: Lack of private interest means entire cost would be borne by state3) Replacement of natural gas-fired electricity generation capacity with renewables (e.g.Susitna hydro, Fire Island wind, Eva Creek wind, Mt Spurr geothermal), coal, coalbed methane, or underground coal gasification (UCG).

-Timeframe: Variable. A large project like Susitna could not be completed before 2023 but both Fire Island Wind and Eva Creek wind should be online in 2012.

-Up front cost: High ($6 billion for Susitna, a few million per MW of wind)

-Long-term costs: Very low for renewables, presumably higher than natural gas for coal, coalbed methane, or UCG.

-Other: Over 30 billion cubic feet of natural gas are currently used for heating, not electricity. Displacing heating gas would require additional infrastructure and investment.4) Importing liquefied natural gas (LNG) from outside the state

-Timeframe: Short

-Up front cost: $500 million for re-gasification infrastructure

-Long-term costs: Depends on the market for natural gas - higher than current prices

-Other: This option i[s a virtual certainty](http://www.alaskadispatch.com/article/importing-lng-thats-just-way-it), at least as a stopgap measure.A detailed 2006 study commissioned by the Alaska Natural Gas Development Authority (ANGDA) examined over 20 different options from these four categories and ranked each option based on factors such as cost, feasibility, uncertainty, and impact on Alaska citizens. The study authors concluded that immediate steps needed to be taken to conserve gas in the region and to and increase production in Cook Inlet. The commission’s next priorities were intermediate development of coalbed methane, and long-term development of a pipeline from the North Slope, and/or development of Alaskan coal and wind resources.

While increased gas conservation has already occurred as a result of higher prices, little effort has been made towards the rest of these goals since 2006.

A Turnaround?

In response to falling natural gas resources, the state has created an extremely favorable tax environment for companies in order to boost exploration. Enticements include tens of millions of dollars in tax credits for exploration wells, a 2.5-fold increase in the tax credits available for development, and additional credits for small operations, nonconventional operations, and gas storage facilities.

In June 2011, the USGS released a report (3.8 MB) that estimated that Cook Inlet holds 19 trillion cubic feet (tcf) of technically recoverable natural gas, enough to supply Alaska for 200 years at the current rate of demand. “Technically recoverable” means the gas could be recovered with existing technology, but doesn’t mean to do so would be economical. Nonetheless, the USGS report has prompted talk of a“Renaissance” for natural gas in Cook Inlet.

The combination of the resource estimate, favorable tax environment, and high oil prices has prompted a renewed push of exploration in Cook Inlet, with at least four new companies entering the area in 2011. In November 2011, Escopeta announced the discovery of a field containing 3.5 trillion cubic feet of natural gas, the largest such discovery in over 25 years. However, this estimate was later downgraded to 750 billion cubic feet. An updated study released in March 2012 concluded that even with new projects currently in development, there will be a shortage of gas by 2014 or 2015. However, in July 2013 Hilcorp announced a contract that would provide the area with enough natural gas to last through at least 2018 which would allow more time for ongoing exploration to pan out. Prospects looked so good by Fall 2013 that the state asked Conoco Phillips to reopen their LNG plant and to pursue an export license.

Environmental Impact

Natural gas has an environmental impact somewhere in the middle of the spectrum for energy sources. If dwindling gas supplies are replaced by renewable power sources, the pollution and impact of energy generation in the Railbelt will drop substantially. If gas is replaced by coal, the pollution and impact (both locally and globally) will be greatly increased.

Conventional natural gas wells have a much smaller footprint than coal strip mines, and don’t carry the risks of an oil spill. Compared to renewable sources, using natural gas for electricity generation produces 5-150 times as much carbon dioxide, significantly adding to the problem of global warming. However, per unit energy, gas produces half the carbon emissions of coal.

Exporting adds to natural gas’ environmental impacts. Increased ship traffic associated with LNG export/import has raised concerns about fuel oil spills, effects on marine mammals, and the introduction of invasive species through ballast water dumping in Cook Inlet (the majority of which is currently from LNG tankers).

Conclusions

It seems clear that the falling natural gas reserves in Cook Inlet will present a significant political and logistical challenge in coming decades. Solutions will almost assuredly involve higher prices, and will probably involve a combination of alternative sources of supply and alternative sources of generation.

Further Reading

- > "Cook Inlet Oil and Gas Activity 2011". Summary and map produced by the AK DNR.

- > Cook Inlet Gas Study - An Analysis for Meeting the Natural Gas Needs of Cook Inlet Utility Customers (2010) prepared for Enstar, Chugach, and ML&P by Petrotechnical Resources of Alaska

- > Cook Inlet Natural Gas Production Cost Study (2011) prepared by the Alaska DNR Oil and Gas Division

- > Assessment of Undiscovered Oil and Gas Resources of the Cook Inlet Region, South-Central Alaska, 2011 prepared by the USGS

- > Cook Inlet Energy Supply Alternatives Study Final Report (2006) prepared for the Alaska Natural Gas Development Authority by Dunmire Consulting.

- > Alaska Railbelt Electrical Grid Authority (REGA) Study Final Report (2008), prepared for the Alaska Energy Authority (AEA) by Black and Veatch

- > Cook Inlet Gas Study - 2012 Update

Created: Jan. 19, 2018