- an essay by David Coil

- Summary

- Background

- Environmental Impacts of Gold Mining

- Industrial applications for Gold

- Gold as Adornment

- Gold as an investment

- Where do we go from here?

- Conclusions

an essay by David Coil

Summary

Gold is both highly valuable, and relatively useless. The vast majority of gold mined throughout history is now jewelry, or stored in vaults as an investment. However, gold mining has a devastating effect on the environment and is being mined in lower quality deposits than ever before. There is already plenty of gold to go around–the perceived value of gold means that it is rarely wasted or thrown away, and even gold mined centuries ago is still in circulation. The jewelry market and gold hoarding for investment drive the price of gold and the demand for gold mining. Therefore, reducing demand for gold jewelry and investments can directly reduce the dramatic environmental impacts of gold mining. And it’s not just an aesthetics question; the hidden costs of gold mining are paid by everyone, now and in the future.

In short, if you sell your gold, or reduce your gold purchases and investments, you will be doing the environment and future generations a big favor.

— Get Photo

Background

The historical rise of gold as a measure of worth is not hard to understand. Gold doesn’t tarnish or decay, can be highly polished, is malleable, ductile and is naturally found in an almost pure form, ready to be worked. Gold is also found all over the world, and became a measure of worth in a large number of societies, providing common ground for early global trade. Gold has long been associated with rulers and gods, and highly prized for both adornment and wealth. In modern times, gold formed the basis of most currencies through the “gold-standard”, abandoned by the US in 1971, and by Switzerland, the last remaining holdout, in 2000. Nowadays the amount of gold held by central banks is only a fraction of the amount of money in circulation.

Environmental Impacts of Gold Mining

Because gold has been sought after for so long, most of the easily accessible deposits have been mined. Instead of picking gold nuggets out of a stream, most modern gold mining takes the form of massive strip mines that process billions of tons of ore in order to extract relatively small amounts of gold. As a result, gold mining on average suffers from diminishing returns. Larger and larger mines are needed to extract smaller and smaller amounts of gold. Extracting enough gold from the earth to make a single gold ring creates, on average, 20 tons of mining waste.

Gold mining has negative impacts on the environment, regardless of where it occurs. In developed and heavily-regulated countries like the US, gold mining uses massive quantities of cyanide, has major problems with acid mine drainage (often in perpetuity), and usually takes the form of massive strip mines. In less-regulated regions of the world, the use of large amounts of mercury, and the creation of significant water and air pollution, adds to the impacts. Gold mining in some regions also entails poor working conditions, human-rights issues, over reliance on a single resource, and negative geopolitical consequences such as fueling wars and supporting dictators.

Industrial applications for Gold

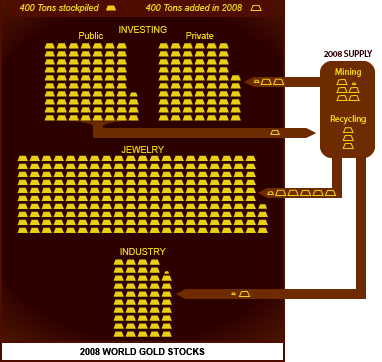

Though demand is high, gold has relatively few practical applications. The primary uses are in electronics and dentistry, with small amounts used in numerous minor applications ranging from cosmetics to aerospace. Industry acquires most of its gold by recycling pre- and post-consumer scraps. Industrial applications demanded around 11% of the 2009 gold market. Virtually all newly mined gold is made into jewelry and bars or coins.

Gold as Adornment

The use of gold for adornment goes back well before the emergence of written history. For thousands of years people have worn gold either for its intrinsic beauty or as a symbol of wealth. Currently, 51% of the gold in existence is found in the form of jewelry and 68% of new demand (down from88% in 2000) is for jewelry as well. The accumulation of gold jewelry can serve economic, as well as aesthetic, purposes.

Gold as an investment

The price of gold reached a 30-year nominal high of $1,910 in August 2011, helped along by the recent recession after rising steadily for several years. To many investors, high prices vindicated the perceived investment value of gold, and confirmed that in tough economic times, people turn to the stability of gold over more volatile commodities, stocks, bonds, and other containers for wealth.

However, gold is no different than any other investment. Prices go up, and prices go down. Anyone who bought gold at its peak in 1980 and sold it during the current peak would still have lost a significant amount of wealth compared to someone who stuffed the same amount of money in a mattress.

Gold isn’t necessary for finance. We have functioning paper currency systems, none of which are backed by gold. Many people are uncomfortable with the modern idea of “fiat money”, i.e. any currency that isn’t backed by a tangible object. However, gold itself only has an arbitrary perceived “value” since its utility is low. The heated debate on the relative merits of fiat money versus the gold standard is outside the scope of this essay, but suffice it to say that the majority of mainstream economists believe that a return to the gold standard would be both impossible and a bad idea. Not to mention that a return to the gold standard would necessitate a vast and widespread expansion of destructive gold mining as every country rushed to increase their gold reserves.

Some people hold gold with the rationale that if the current system of digital and paper money comes to a catastrophic end, people with gold will still have something of value. However the low utility of gold might mean it actually would have little value in a world where money as we know it has come to an end. Associated collapse of government, transportation, and energy infrastructure might leave people more interested in commodities that can directly provide food, water, or shelter.

Where do we go from here?

Use less gold

The only way to reduce demand for gold is to change the desires of consumers and investors. The choices of individuals have power. The simple choice of consumers to buy less gold jewelry (which accounts for virtually all of the gold newly mined each year) could lower the market value of gold. At the very least, consumers can demand to know where the gold that they’re buying comes from and whether it was mined relatively responsibly. Steps have been taken in this direction, most prominently by The Initiative for Responsible Mining Assurance and the No Dirty Gold campaign’s “Golden Rules”. However, gold is hard to trace and is often mixed from numerous sources.

Reduce gold hoarding

Alternatively, central banks could begin to sell off their gold hoards, perhaps for financial or environmental reasons. The current 30,000 tons of gold held by central banks would supply worldwide industrial and dental demand for 80 years even without recycling or any mining. This might also lower the price of gold, thereby reducing the appeal of gold as an investment and changing the economics that lead to large-scale destructive gold mining in the first place.

In fact investors in general could consider the environmental impacts of gold mining and chose to put their money elsewhere, much like the push to avoid “conflict diamonds” in the last 15 years. Similarly, conversion of existing jewelry stocks to industrial purposes would supply enough gold for centuries without the need for any further mining. Add in the fact that a very high percentage of industrial gold is recyclable and it’s clear that the world already has enough gold for a very very long time.

Change the economics of gold mining

Ecological and health impacts resulting from mining are not included in the cost to extract gold since they are paid by taxpayers, affected residents, or future generations. If communities and governments forced mining corporations to address the “true cost” of their mining operations, many mines would not be viable. The Zortman-Landusky gold mine in Montana provides extreme example of a gold mine avoiding the true cost of their operation. They profitably extracted gold while causing significant environmental damage. When the mine was nearing closure, they rolled their profitable assets into another company, and declared bankruptcy. Montana and the Federal government are now facing tens of millions of dollars in perpetual cleanup costs. In this case and many others the true cost of a mining operation was not reflected in the balance sheet of the mining corporation.

Efforts have been made to address this in the form of “reclamation bonds” paid by mining corporations to begin mining, but have in most actual cases been woefully inadequate to cover cleanup costs. A regulatory regime that placed all the cost burdens on a mining company instead of the state would then raise the economic barriers to destructive mining practices.

Lastly, many mining operations are subsidized in the form of land access and tax breaks.

This means that governments are in effect lowering the cost of environmentally destructive mining, contributing to demand by hoarding large reserves, and then directly paying for the costs of mine cleanup. All this in return for no material benefit to taxpayers.

Conclusions

Gold occupies a unique position for mankind with its long history as a highly valued commodity that currently serves little utility to society. However, gold mining comes hand in hand with long-term environmental destruction. By selling off our gold or reducing consumption–whether jewelry, investments, or institutional hoards–we could reduce the price of gold and thus the destructive mining, with no threat to our way of life.

Further Reading

- > USGS "Minerals Yearbook" Gold Chapter

- > World Gold Council website

- > USGS, Mineral Commodity Summaries - Gold (2010)

- > "No Dirty Gold" campaign website

- > Gold at What Price? (2000) prepared by the Mineral Policy Center

- > USGS "Gold Recycling in the United States in 1998"

- > Does Gold Mining Matter? (an article on how the gold price is formed, 2009)

Created: Jan. 19, 2018